Ukraine: What Every Revolutionary Should Know.

03/24/2022

US Strategic Issues in the War in the Ukraine

US capitalists think they know what they are doing. Once considered the “lone superpower”, the US is both seizing the initiative to force the world into a new world of geo-political relations.

The Ukraine War is one front of a global Hyper War that the US is waging against the people of all humanity in an attempt to give capitalism a few more years of existence.

This war rises upon new forms and circuits of military accumulation of global capital.

Since 2001, and especially since the Arab Spring in 2011, the people of the world have been involved in a steadily-increasing, low-level global civil war as military accumulation and force defend capitalism in almost every country. The twin devastations of the pandemic, plus the financial collapse, add to the crisis of global warming and environmental collapse.

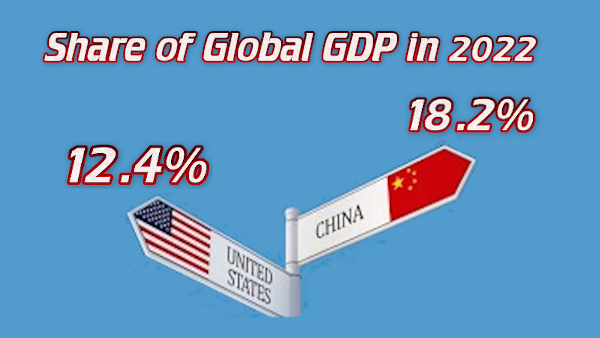

US financial capitalism relies on its massive economy and equally massive military to compel global events in its favor. However, many countries today have an independent productive capacity that allows for multi-national opposition, unlike in previous eras.

The global financial system is being restructured for the first time since digital technology changed the rules of the game for capitalism. To the degree that this technology reorganizes every branch of industry, human labor is replaced and therefore can no longer be exploited to create surplus value that supports private profit and private property. Unpredictable and unintended consequences, both economic and political, will rebound on the United States, already driven by irreversible processes toward crisis.

Private property is on the offensive around the world. This, however, is an expression of weakness of capitalism, which devastates humanity and the planet, and is striving to move to a system of private property that goes beyond simply exploiting labor power.

……………….

1 With Covid, capitalism shifted the burden of the disease to people globally and raped the world with trillions of dollars. The massive leap in the private profits of global billionaires and oligarchs alone is enough to vaccinate the entire world. But capitalism does not work that way.

The pandemic itself is a massive global crisis. By March 2020, the global financial collapse that followed produced one of the two greatest economic collapses in history.

The global rebellion against capitalist policies (if not capitalism) was surging before COVID hit in 2020. Since 2018, there have been over 230 major anti-government protests in over 110 countries that have forced more than 30 governments to fall. Virtually no government today is seen as legitimate by large sectors of its public. (1)

The rebellion actually accelerated during the first two years of the pandemic. The US faced 1000 strikes at the beginning of the pandemic. These morphed into the massive George Floyd protests and the “Great Resignation.” William Robinson:

… the system has been undergoing a new round of restructuring and transformation since the financial collapse of 2008, based on a much more advanced digitalization of the entire global economy and society. The contagion has turbo-charged these transformations….

… The era of globalization has involved an ongoing radical transformation in the modalities of producing and appropriating surplus value. There is an extreme and still increasing concentration and centralization of capital on a global scale in the financial conglomerates that in turn act to interlock the entire mass of global capital. Now the system is undergoing a new round of restructuring and transformation based on a much more advanced digitalization of the entire global economy and society. The agents of global capitalism are attempting to purchase for the system a new lease on life through this digital restructuring and through reform that some among the global elite are advocating in the face of mass pressures from below. (2)

This was the general situation before Russia invaded the Ukraine in February 2020. The war is a symptom of the global capitalist crisis, not the cause.

2 The global financial system, which has been in place since the mid-1970s, has objectively run its course. The entire geopolitical system is undergoing radical restructuring as we watch in real-time.

When the US seized $300 billion of Russian dollar reserves early in the Ukraine War, every country in the rest of the world understood that the US can do this to any country at any time. The US well understood that it was effectively declaring the end to the global financial system, based on the primacy of the dollar, that has been in place since the mid-1970s. As soon as Russia invaded the Ukraine in February, Germany flew plane after plane to New York to carry the country’s gold back to keep it “safe”.

Segei Glazyev is the Russian minister in charge of integration and macroeconomics of the Eurasia Economic Union (EAEU):

“Having “frozen” Russian foreign exchange reserves in custody accounts of Western central banks, financial regulators of the U.S., EU, and the U.K. undermined the status of the dollar, euro, and pound as global reserve currencies. This step sharply accelerated the ongoing dismantling of the dollar-based economic world order.” (3)

Even though the outspoken goal of US policy since 2010 or so has been to separate Russia and China, they instead are pushing them off the dollar and forcing them to build deeper economic ties. The US is choosing to do this. Michael Hudson:

What the United States has done itself is exactly what both Lavrov and President Xi of China have been saying the world must move towards.

They’ve been saying we must have a multinational world, a multipolar world. We must be de-dollarized. We must cut free of the dollar and isolate, protect ourselves from the United States’ ability to use sanctions, to interrupt our economic activity, to use oil to threaten any country that doesn’t follow U.S. policy from having their energy reserves cut off, to protect countries that don’t produce their own food from being able to buy food and feed themselves.

If they do something the United States doesn’t like, if they do not open their markets to the United States if they do not privatize their infrastructure. So everybody thought for the last five years: How will Russia and China and their allies, India, and Iran, create this new world order? Well, the United States has accelerated this process.

The rise of Globalization, since the fall of the Soviet Union in 1991, has been based on the primacy of the dollar, backed up by an enormous and aggressive military, a system which has created enormous amounts of global debt and fictitious paper wealth. This development was augmented by the rise of electronic technology that served to create a global production system as well as a parasitic system of legal and illegal global financial speculation. (4)

In the face of every war and economic crisis in the 20th Century, the US state, controlled by finance capital, seized the initiative to intervene and reform the system of global finance. The last time this happened was in the early 1970s when Nixon took the dollar off the gold standard and let it float against other world currencies. This led to the financial system that has controlled global production for 50 years.

International, global, and transnational financial systems are unstable under capitalism

The US, therefore, has used the war in the Ukraine – a war which it both provoked and strives to engineer – to seize the initiative to maintain its privileged global position in determining the architecture of the new global financial system that is already objectively taking shape.

The global speculative system is already some 14 times greater than the global system of production that produces products.

In 2018, for example, the gross world product, or the total value of goods and services produced in the world, stood at some $75 trillion whereas the global derivatives market –a marker of speculative activity– was estimated at a mind-boggling $1.2 quadrillion.

The total cash held in reserves of the world’s 2.000 biggest non-financial corporations increased from $6.6 trillion in 2010 to $14.2 trillion in 2020 –considerably more than the foreign exchange reserves of the world’s central governments– as the global economy stagnated. (5)

That such massive amounts of speculative capital dominate means that, as always under capitalism, the new global system will privilege private property over human needs and the environment of our already-menaced planet.

3) To achieve its ends, the US has launched a Hyper War against the countries of the world. Hyper War describes the War in the 21st Century where the use of massive land-based armies and giant naval fleets (the World War II model of war) is a thing of the past. With Hyper War, augmented with digital technology, everything is weaponized, from finance and debt to social media and food. These weapons are then combined into strategic war-making.

All forces at play in the Ukraine War routinely use computers to war-game out every move, possibility, and option. While unintended consequences will objectively take place, there is plenty of intentionality behind what is portrayed as merely collateral damage.

• The unprecedented sanctions on Russia immediately hurt the economies of Europe and the Global South by driving the costs of petroleum, grain and fertilizer, not to mention other critical global products, right through the roof. The financial repercussions are unknown and vast and directly threaten the global financial system. Is it possible that the US did not understand that India’s dependence on Russian fertilizer would mean that they would drop the dollar and trade rupees for rubles instead? How could it have not? The US has chosen to destabilize the global economy.

Capitalism has reached the point where the State is the market of last resort. Big Pharma received billions in free research and vaccine subsidies. Now, with the war in Ukraine, the Military-Industrial complex and the petroleum companies are demanding – and receiving – unprecedented subsidies as well. The result is massive destabilization of the geopolitical system.

Moreover, as repression becomes more systematic and generalized, the system becomes more dependent on militarized accumulation, that is, on a global war economy that relies on perpetual state-organized war-making, social control, and repression, driven now by new digital technologies, in order to open up and sustain opportunities for profit-making. (6)

One major US objective is to force Europe to give up inexpensive Russian gas for highly costly US energy. These maneuvers strengthen the dollar against the Euro even as inflation is rising. The US is deliberately provoking a war in Europe to subordinate those countries to US control. Brexit was much about Britain accepting the privatized US health care system. Much of Europe’s “social safety net” is yet to be privatized. NATO policy has become European foreign policy… to the serious detriment of the people of Europe. How long can these governments abjectly follow US dictates?

The Global South has been dependent on the dollar and the global economic structure enforced by debt from the IMF, the World Bank and the World Trade Organization.

The sharp rise in energy and food prices will hit food-deficit and oil-deficit economies hard – at the same time that their foreign dollar-denominated debts to bondholders and banks are falling due and the dollar’s exchange rate is rising. Many African and Latin American countries – along with North Africa – face a choice between going hungry, cutting back their gasoline and electricity use, or borrowing the dollars to cover their dependency on U.S.-shaped trade.

Or they can go off the current dollar system. These countries have little incentive to pay back their loans if there an independent global system arises. This completely predictable result will continue to support the rise of a new financial system, now led by Russia and China.

So, all of a sudden this last week, you’re seeing the world economy fracture into two parts, a dollarized part and other countries that do not follow the neoliberal policies that the United States insists that its allies follow. We’re seeing the birth of a new dual World economy. (7)

• Inflation was well underway before Putin invaded. Even the Wall; Street Journal admits that “This isn’t Putin’s inflation.” The International Monetary Fund has announced that the global economy is entering a major slowdown, downgrading the growth prospects of 143 countries. At the same time, inflation rates have reached historic levels.

In 1971, the cost of ramping up the war in Vietnam, plus fortifying the military-industrial complex, created massive inflationary pressure against the dollar. Today, the massive bailout of the financial sector by central banks after COVID hit added $17 billion to the global system. This magnified the distortions already produced by US military spending and by the Wall Street-Dollar-IMF regime gripping the world economy.

The US consumer market absorbs a fifth of the world’s goods and services; as the demand for these goods outstrips the global supply, the tendency for US inflation to spread around the world is very high. The average Commodity Research Bureau Index, a general indicator of global commodity markets, has risen astronomically: as of 25 April, year-to-year prices have soared for oil (60%), palm oil (60%), coffee (56%), wheat (45%), natural gas (139%), and coal (253%). These price increases have sent shock waves through the global economy. This instability is inseparably connected to US economic policy.

Since 2020, the United States has increased its budget by $2.8 trillion. To finance this budgetary expansion, the government increased borrowing to 27% of the gross domestic product (GDP), and the Federal Reserve Bank increased the money supply (the quantity of money issued) by 27% year-on-year. Both of these increases are the highest in US peacetime history. (8)

Global inflation is an objective development, but it can be directed by policy. The conclusion then is that the US is deliberately employing inflation as a weapon to achieve its strategic goals.

• US financial capitalism was dazzled by the prospect of a billion+ workers entering the global capitalist system after the collapse of the Soviet Union in 1991, plus the rise of China’s manufacturing potential. As usual, capitalist short-term thinking leads to strategic blunders. The US moved much of its productive capacity out of the country as the globalized system of manufacture developed. Thus, over the last 30 years, the Global South and Asia developed modern economic productive capacity that is independent of the productive capacity of the US. This is the objective basis for the rise of multi-polarity.

Another result was that US capitalists prioritized the financialization and securitization of the country’s productive capacity as a means of extracting more money. The US war against the global system of production is intended to extend such parasitic financial extraction to the rest of the world.

The US goal is to financialize and privatize every form of government-supported infrastructure, from roads and ports to food support and national banking systems. This is what US Secretary of State, Anthony Blinken, means when he said that China’s actions “threaten the rules-based order that maintains global stability.”

(China) realizes that there’s a difference between earning income and creating wealth by employing labor to produce goods, to sell at a profit and then reinvest these profits and more capital formation, in contrast to simply buying a rent-yielding property, buying land and letting it rise in price without the landlord doing anything, buying a monopoly and just raising the price – charging monopoly prices like the US pharmaceutical companies are doing. China understands the difference between earned income and unearned income, between productive investment and unproductive investment.

In the United States, if they do recognize this difference, they realize that via unearned income you can make wealth by parasitically much quicker than you can actually create real wealth. It’s cheaper to be a parasite than a host. And so most of the financial strategy of Wall Street involves how to get something for nothing. (9)

In the US, over the last five years, we have seen how the financialization of housing is destroying the lives of the working class. Housing is the miner’s canary for the coming new world order.

(The One Percent) have made money either by taking property from the public domain by privatization, or it’s made today by the central banks, lowering interest rates, flooding the market with credit, enough credit to push up real estate prices 20 percent in the United States in the last year. Housing prices have gone way up to unaffordable levels, pushing up education prices – and education is priced at whatever a bank or the government will lend you to pay with a student loan. It’s all financialization. (10)

If we step back and put these events in the historical context of capitalism, we see that the rise of financialized capitalism is the dominance of fictitious capital over real-world productive capital. The US hyper war then is a war of financialized riches against the productive side of the global economy that produces real wealth.

At a certain point, however, speculative fictitious capital cannot continue to constrain real-world production. That force – the continued disintegration of the capitalist system due to digital technology – is part of what’s driving the current crisis.

4) What will the new global financial system look like? On March 9, President signed an executive order directing the government to begin developing a “central bank digital currency” (CBDC) to be issued by the Federal Reserve, alongside a framework to regulate private cryptocurrencies.

Nick Corbishley describes this development –

Around 90 central banks are either in the process of experimenting with or are already piloting central bank digital currencies (CBDCs). In a world of just over 190 countries that is a large contingent, but given they include the European Central Bank (ECB) which alone represents 19 Euro Area economies, the actual number of economies involved is well over 100. They include all G20 economies and together represent more than 90% of global GDP.

Three CBDCs have already gone fully live in the past two years: the so-called DCash in the Eastern Caribbean, the Sand Dollar in the Bahamas, and the Naira in Nigeria. The International Monetary Fund, the world’s most powerful supranational financial institution, has been lending its expertise in the rollout of CBDCs. In a recent speech, the Fund’s President Kristalina Georgieva lauded the potential benefits (on which more later) of CBDCs while heaping praise on the “ingenuity” of the central banks busily trying to conjure them into existence.

Also firmly on board is the world’s largest asset manager, BlackRock, which helps many of the world’s largest central banks, including the Federal Reserve and the ECB, manage their assets while obviously keeping all potential conflicts of interests at bay. The fund was the largest beneficiary of the Federal Reserve’s bailout of exchange-traded funds during the market rout of Spring 2020.

In his latest letter to investors, the CEO of BlackRock, Larry Fink, said the Ukrainian conflict has the potential to accelerate the development of digital currencies across the world. (11)

The speed of establishing this new form of money is dramatic. It was only in January 2022, that the US Federal Reserve issued a report that supposedly opened up the debate for full discussion by the American people.

From the Federal Reserve’s report (12):

A CBDC could potentially offer a range of benefits. For example, it could provide households and businesses a convenient, electronic form of central bank money, with the safety and liquidity that would entail; give entrepreneurs a platform on which to create new financial products and services; support faster and cheaper payments (including cross-border payments), and expand consumer access to the financial system. (p 3)

Another potential benefit of a U.S.-issued CBDC could be to preserve the dominant international role of the U.S. dollar. The dollar is the world’s most widely used currency for payments and investments; it also serves as the world’s reserve currency. The dollar’s international role benefits the United States by, among other things, lowering transaction and borrowing costs for U.S. households, businesses, and government. The dollar’s international role also allows the United States to influence standards for the global monetary system. (p 15)

In response to Russia’s invasion of the Ukraine, there has been much talk about expelling Russia from the SWIFT system of international payments. This system is slow and totally out-of-date. Each step of a transfer requires various fees and delays. All this is eliminated by a global system of digital finance. When faced with a choice between the two, global finance will jettison the SWIFT system in a hot minute.

The general consensus is that the new global financial architecture will be some form of a global basket of digital currencies. However, things are still in the initial stages.

And more ominously…

An intermediated model would facilitate the use of the private sector’s existing privacy and identity-management frameworks; leverage the private sector’s ability to innovate, and reduce the prospects for destabilizing disruptions to the well-functioning U.S. financial system. (p 14)

In other words, the already-existing privatized corporate surveillance system will control access to digital currency. Already, the US uses the current system to sanction individuals, ie Russian oligarchs. But the potential exists with digital currency to sanction any individual and cut them off to access to money with a click of a button. People could be “sanctioned” depending on how they vote, or what commodities they buy or an article they write.

But, hold on a minute… Why go to all the trouble of creating the digital currency, when the exact same system of distribution could be easily accomplished with one simple step, by abolishing money? The system of real-world production currently drives how the global product is distributed. Total universal access to CBDC, which is the promise, simply creates the infrastructure for distribution without money.

In the Communist Manifesto, Marx wrote the famous lines, “All that’s solid melts into air.” We are seeing this happen with money! This is one aspect of the transition to digital technology, which augments the production without the human labor, that increasingly defines human society.

A cashless society is already perfectly viable. It can be used as a tool of fascism, but it can be done the easy way as the infrastructure of global communism.

5) The International Monetary Fund is playing a key role in creating CBDCs. It also proposes a new plan for the future of capitalism, roughly summarized as the Wall Street Consensus. The IMF published Billions to Trillions in 2015. The idea is that the national governments in the world financial system will securitize public money in the billions to supposedly guarantee that private property – corporations, LLCs, public-private-partnerships forms of debt and their ilk – can make a profit by investing trillions… to solve the great problems that face humanity today!

The Wall Street Consensus is an elaborate effort to reorganize development interventions around partnerships with global finance. The UN’s Billions to Trillions agenda, the World Bank’s Maximizing Finance for Development or the G20’s Infrastructure as an Asset Class update the Washington Consensus for the age of the portfolio glut, to ‘escort’ global (North) institutional investors and the managers of their trillions into development asset classes.

Making development investible requires a two-pronged strategy: enlist the state into risk-proofing development assets and accelerate the structural transformation of local financial systems towards market-based finance that better accommodates portfolio investors.

Ten policy commandments forge the ‘de-risking state’. They create a safety net for investors in development assets, protecting their profits from demand risks attached to commodified infrastructure assets; from political risks attached to (progressive) policies that would threaten cash flows, including nationalization, higher minimum wages, and, critically, climate regulation; and from liquidity and currency risks. These risks are transferred to the balance sheet of the state.

The new ‘development as de-risking paradigm narrows the scope for a green developmental state that could design a just transition to low-carbon economies.

(13 – emphasis added)

6) The aggressive financialization of Nature under Wall Street Consensus is already well underway.

… global capital has been ruthlessly pursuing intensive expansion; the commodification of what were non-commodified spheres, such as health and educational systems, infrastructure and other public services, public lands and nature reserves, military and police forces, prisons, and most recently, outer space. (14)

John Bellamy Foster reports on a massive new gold rush to seize and privatize “natural capital” such as “emerging natural capital markets such as water-quality trading, wetland banking and threatened species banking, and natural carbon sequestration.” Speculators have determined that the net present value of “ecosystem services” is $4 quadrillion.

Here’s just one example:

On October 28, 2021, political leaders in the Malaysian state of Sabah on the island of Borneo signed an agreement with the Singapore shell company Hoch Standard, without the knowledge of Indigenous communities, giving the company title to the management and marketing of “natural capital/ecosystem services” on two million hectares of a forest ecosystem for one hundred to two hundred years. Although the full nature of the agreement has not been disclosed, journalistic investigations and a lawsuit filed by Adrian Lasimbang, an Indigenous leader in Malaysian Borneo, have revealed that the Nature Conservation Agreement allowed Hoch Standard—a holding company with two officers and a paid-up capital provided by shareholders of a mere $1,000 U.S. dollars, but backed by undisclosed multibillion-dollar private-equity investors—to acquire commercial rights to the natural capital in Sabah’s forest ecosystem. The revenue from the rights to ecosystem services, such as water provisioning, carbon sequestration, sustainable forestry, and biodiversity conservation, over the next century, was estimated at some $80 billion, with 30 percent, or $24 billion, to go to Hoch Standard. It was stipulated that the Sabah government could not withdraw from the agreement, while Hoch Standard could sell its rights to the natural capital in the Sabah Forest to other investors without government consent. (13 – emphasis added)

Conclusion —

The US provoked the war in Ukraine and is using it as an element in a Hyper War against the peoples of the world in order to re-engineer the faltering architecture of global finance. This will be re-organized around Central Bank Digital Currencies as an element in new systems of financialization and privatization. The road is being prepared for private property to seize and control every component of Nature as well as public property. Yet at the same time, capitalism is incapable of providing the basic necessities of life for the people of the earth.

The Ukraine war rises on top of a smoldering global militarization that is aimed at controlling the rising growing global movement that is becoming more conscious of the need to abolish capitalism and private property.

—- Steven Miller, May 5, 2022

References

1) https://carnegieendowment.org/publications/interactive/protest-tracker

2) William I Robinson. Can Global Capital Endure? https://robinson.faculty.soc.ucsb.edu/Assets/pdf/REG%20Robinson%20Can%20Global%20Capitalism%20Endure%20pdf%20published.pdf

3) Pepe Escobar: On the Dawn of a New Global Financial System

April 15, 2022

https://consortiumnews.com/2022/04/15/pepe-escobar-on-the-

-escobar-on-the-dawn-of-a-new-global-financial-system

4) Ukraine The Economic Fallout. Consortium News Live. March 31, 2020

5) Robinson, ibid

6) Robinson, ibid.

7) Michael Hudson. “Clearing the Fog”, March 30, 2022. Michael-hudson.com

8) Tricontinental – Institute for Social Research. “I Cannot Live on Tomorrow’s Bread: The Seventeenth Newsletter (2022)”. https://mronline.org/2022/04/29/i-cannot-live-on-tomorrows-bread/

9) Michael Hudson. “Renegade Inc.: China’s Fortune Cookie Crumbles.” September 27, 2021

https://mronline.org/2021/10/04/chinas-fortune-cookie-crumbles-michael-hudson-and-renegade-inc/

10) Hudson, ibid

11) Nick Corbishley. “Unbeknown to Most, A Financial Revolution Is Coming That Threatens to Change Everything (And Not for the Better)”. March 25, 2022. https://macro.economicblogs.org/naked-capitalism/2022/03/corbishley-unbeknown-financial-revolution-threatens-change/

12) US Federal Reserve. Money and Payments: The U.S. Dollar in the Age of Digital Transformation. January 2022. https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

13) Daniela Gabor. “The Wall Street Consensus”. 26 March 2021. https://doi.org/10.1111/dech.12645 – Emphasis added

14) Robinson, ibid.

15) John Bellamy Foster. The Defense of Nature: Resisting the Financializaton of the Earth.

Monthly Review. Apr 01, 2022. https://monthlyreview.org/2022/04/01/the-defense-of-nature-resisting-the-financializaton-of-the-earth/